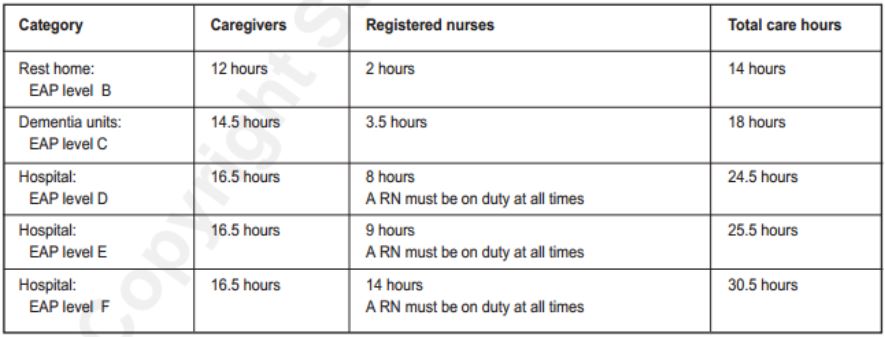

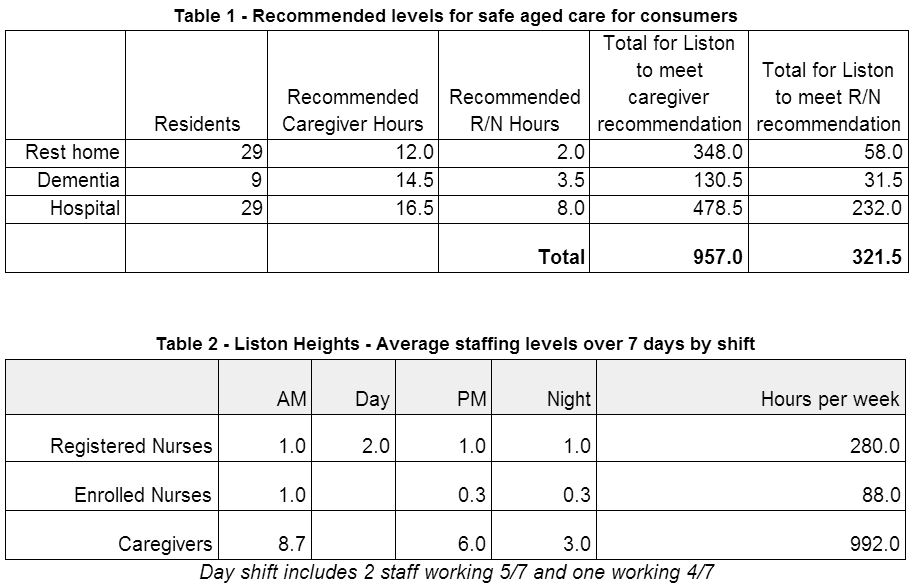

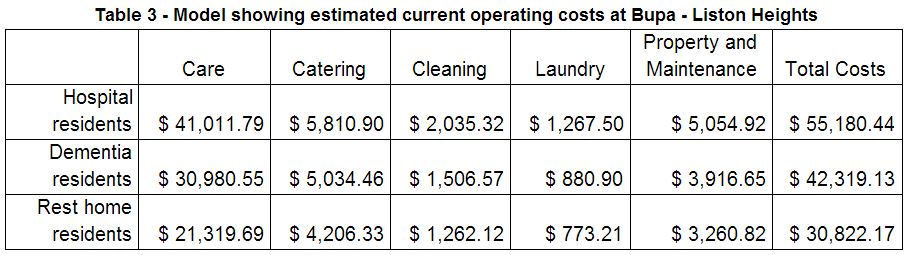

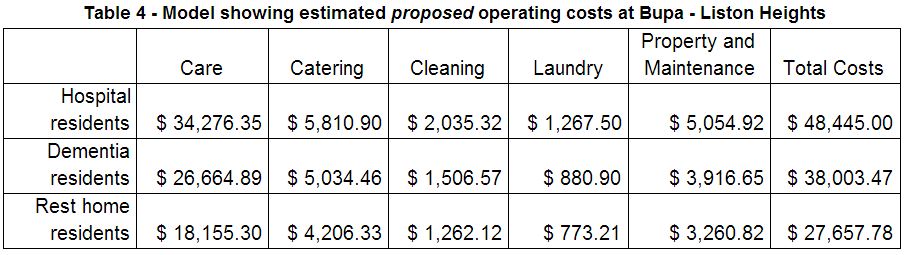

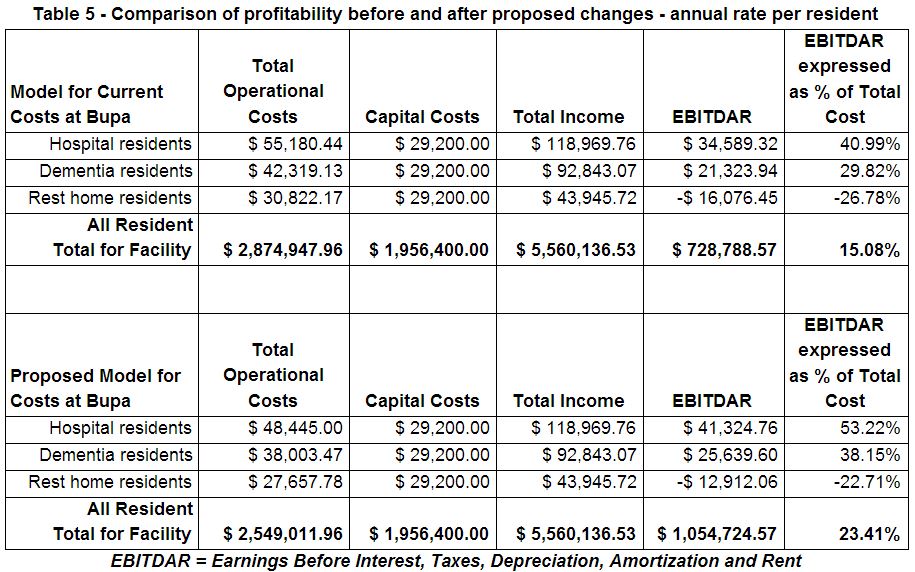

“People Love Working at Bupa” - An alternative view by Gregg Sheehan“We have committed to Bupa being a place where people love to work and where they are healthier because they work with us. We are proud of the affinity our people have with Bupa’s purpose and the customer care they provide every day.” So, where did it all start to go wrong at the Bupa facility at Liston Heights in Taupo? The company only “cares” about people when there is a profit to be made, and it seems that it has to be a substantial one at that. If it perceives any lowering of profitability from (as far as I can tell), a 23% return on investment, it is quick to “disinvest its operations” as evidenced by its “forced” closure at Gisborne. (As it happens it is simply repurposing its facility into one focussing on disabled care.) “In order to continue to operate in New Zealand , we are required to make a reasonable return on our investment by our parent company. Where this is not the case, the company will seek to disinvest its operations and this has indeed been the case in Gisborne, where we have been forced to close our Care Home as it was no longer financially viable.” (from the Bupa document handed to staff telling them to choose to do the 4 on 4 off shift regime or risk having their jobs "disestablished) Or it could be that rather than provide more and better care in order to make its facility more competitive and appealing to the aged population in Gisborne, Bupa have found an opportunity to branch out into a more profitable enterprise. “Mr Brown said declining occupancy rates due to an oversupply of rest home beds in the Gisborne district, as well as a need for a rehabilitation service in the region were reasons for this new direction.” We can only make guesses at what the ‘return on investment’ might be for the Taupo facility because the company has not chosen to open its books for us to see just what the actual figures are. The guess I have made is based on the findings of the Thornton Report. (Aged Residential Care Service Review September 2010 - Grant Thornton). An in depth analysis of the operation of aged care homes in New Zealand at the time. “The Thornton report quotes EBITDAR (earnings before interest, taxes, depreciation, amortisation and rent) per rest home resident of $5,068 from a care cost of $16,859 and in hospital level care a return of $9,647 against a care cost of $31,829. Returns of 30% - which even before tax, are extraordinary. And, when Thornton compared “not for profit” rest home operators against the “for profits”, EBITDAR were 68% higher in “for profit” operators.” In their document however the company does come up with some figures to support their claim that “occupancy levels continue to plummet”, by suggesting that occupancy levels “have declined about 10%” over the last two years. By my reckoning there are 2 spare beds in the rest home, 3 spare in the hospital and 3 in the dementia unit. Dire times indeed! Bupa claim that current levels of direct care provided by registered nurses, enrolled nurses and caregivers are 356, 130 and 1120 hours per week respectively. They further claim that these levels are higher than those recommended in the “Indicators for Safe Aged Care for Consumers”. In the table (from the publication referred to) below it can be seen just what the recommended hours are: Using the current occupancy of Liston Heights this would suggest the following: While it can be seen that the level of Caregiver hours is slightly more than that recommended for safe aged-care, the RN hours amount to less. The EN hours may perhaps be optional but there needs to be an RN on at all times. The only real room for movement would be in the day shift staff (who are essentially management and possibly won’t come out of their offices to do the work of the RN on duty anyway). To be fair they should be dropped out of the equation for RN staffing levels as it is debatable whether all of them even need to be qualified RNs. This would bring the RN total hours per week down to 168 and allow the EN hours to perhaps top up the care level inputs of qualified staff. In any case the levels calculated for all types of care staff still fall short of the numbers claimed as being the “existing hours per week” by the Bupa management. Profitability of the organisation Getting around to the profitability or otherwise of the establishment, I find that even using the current staffing hours claimed by Bupa and multiplying by the guesstimated rates for staff of $26/hour for RNs, $18/hour for ENs and $16/hour for Caregivers, the wage component for care costs (when apportioned appropriately over each care group), amount to $30,140, $21,202 and $16,204 for hospital, dementia and rest home residents respectively. If these are adjusted to the levels proposed by Bupa they reduce to $23,405, $16, 886 and $13,040. Assuming that the reduced levels represent a degree of profitability that Bupa Head Office are happy with we can extrapolate the component of direct care that is not wages based on the extensive work carried out by Grant Thornton in his report, Aged Residential Care Service Review September 2010. I have estimated these at $10,870, $9,778 and $5115. After adjusting for inflation for the 3 years since 2010 at a rate of 2.5% per annum (leaving the less significant categories of operating costs as modelled by Thornton), I can estimate the following figures: When figures for income are compared with costs it is evident that there is still quite significant profitability at the current Bupa reported staffing levels (even if these are not exaggerated - see table 2 above). While it is understandable that the Bupa organisation would like to maintain the profitability of the latter scenario, the question needs to be asked if it should be at the cost of the health and wellbeing of its current staff. Also, if it is true that there are more staff than currently recommended, where are they deployed? Are they providing more care for the aged? Surely this is an admirable outcome? Profits made by Bupa do not have to be paid out to shareholders, so they are ploughed back into assets - which make even more profits which are turned into yet more assets. The taxpayer helps fund this expanding juggernaut, twice - first as the taxpayer and then as the resident. Bupa claims to have a history and policy of helping to create more affordable and better health care, yet, if their performance in the aged-care sector in New Zealand is anything to go by, they are charging no less nor providing more care than any other organisation. At the same time they are happy to take advantage of vulnerable staff and see them try to live at a subsistence level. While a person supporting a spouse on an hourly rate of $16 would earn $448 per week on a 4 on 4 off roster. They could get $384 plus an accommodation supplement up to $160 if applying for unemployment benefit. If Bupa is truly interested in providing affordable and improved health outcomes they could hardly do better than use some of their profits in bringing the sector workers up to parity with their counterparts in the DHB while increasing direct care hours in order to provide a safer environment. Is this current crisis the result of greedy staff or poor management on the part of Bupa. While the staff have all contracted in good faith to work the hours they currently have, Bupa have known all along that they were growing capacity while occupancy was unable to keep up. “In New Zealand, revenues and profits increased year-on-year with resident numbers rising. However as capacity grew at a faster rate, occupancy figures slipped to 90.9% from 94.0% in care homes and to 87.5% from 91.1% in care villages. Government spending caps in New Zealand continue to present some financial challenges.” Bupa Half year statement for the six months ended 30 June 2013 In 2010, Thornton predicted two possible scenarios, suggesting actual trends may sit somewhere between. “Scenario A projects that the downward trend in rest home bed days will continue until 2012 before it begins to rise with the growth of the aged population. Scenario B projects a much faster rate of reduction that also persists for longer, until 2015.” Aged Residential Care Service Review September 2010 - Grant Thornton Whatever the situation, there is still enough fat in the system to allow Bupa to maintain the local staff as they are, accepting normal attrition if they wish, until the certain increase in occupancy takes place in the coming months or years.

Bupa was originally set up as a provident society to make things more affordable for the people it served. Somewhere it has lost its direction, as can be seen by this current fiasco, which is putting profit margin before the welfare of its most vulnerable and undervalued asset - its staff. NB: It would be possible to save 28 hours/week of RN time if the management staff opted to work 4 on 4 off.

0 Comments

Background

You have recently received a “Proposed workplace internal change” document and had meetings with your management over a possible shift to a four days on, four days off, roster system. In order to foster the pretence that they are acting in good faith (as they are required to by the Employment Relations Act), they are suggesting that “No decisions have been made” and that “employees are given the opportunity to provide feedback”. However the language of the document is quite disingenuous and it is clear to most of us reading it that the move to a “4-on-4-off rotating roster” is a done deal. (I will only eat my words here if they prove me wrong by announcing “no change to the roster” on 17 February.) What is wrong with the proposal? This proposal will force you into working a part-time 3.5 days a week job. If you currently work a 5 day 40 hour week you will face a drop in income of 30% over a year. If you are a care-giver this means that if your income is about $31,000 per year it will drop to $21,500. A registered nurse might expect to go from say $52,000 to $36,000. Not only will you be forced into part-time work, this type of roster will make it impossible for you to find another part-time job elsewhere. You need to ask yourself if you will be able to continue to afford your rent and other living expenses under this environment. Ask your manager if s/he will also move to a 4-on-4-off. I bet the answer is no. I also suspect that all the managers higher up in the company will receive a bonus if they manage to foist this roster on the care facility. The plea is that the company is having trouble maintaining the sustainability and viability of the Care Home. They are appealing to you to help them do this by reducing your income and conditions of work. They say that they care about fairness to the staff and about delivering a high quality outcome to the aged care residents - but do they? It is well known that workers in aged care facilities are underpaid, under-staffed and under-resourced compared to their counterparts in the District Health Boards. The people employed are often vulnerable overseas workers and others desperate for work. Not only that, most feel they cannot give adequate time to those that they care for. “Many nurses are reluctant to work in the sector because they know there are not enough staff to care properly for the residents they are professionally responsible for.” A Report into Aged Care - What does the future hold for older New Zealanders? October 2010 Lets have a look at BUPA - It is a British company with assets totalling $NZ 3.7 billion. Their financial reports state: “In New Zealand, we opened additional apartments and villas in three care villages and increased capital investment by 20% year-on-year in new builds and refurbishment.” “In New Zealand, revenues and profits increased year-on-year with resident numbers rising. However as capacity grew at a faster rate, occupancy figures slipped to 90.9% from 94.0% in care homes and to 87.5% from 91.1% in care villages. Government spending caps in New Zealand continue to present some financial challenges.” Bupa Half year statement for the six months ended 30 June 2013 Local management would have you believe that all their profits go back into caring for the aged as they are technically a “not for profit” business. But see this: “While BUPA is technically a not‐for‐profit business since it is a provident fund (meaning that it does not have shareholders, and that its surplus income is supposed to be reinvested for the benefit of its customers) this is not a relevant distinction when it comes to its provision of care services in New Zealand. This is because its customers are not the residents of its rest homes, even when they pay fees for their care directly, but rather those who buy individual or company health care insurance with BUPA.” “UPA's British customers seem to be very satisfied with it, as BUPA was the only health insurance company to rate highly in a recent Institute of Customer Service survey of large UK companies. BUPA also remunerates its British and foreign management staff generously, and directs some of its surplus income to the BUPA medical research foundation. ” “The Thornton report quotes EBITDAR (earnings before interest, taxes, depreciation, amortisation and rent) per rest home resident of $5,068 from a care cost of $16,859 and in hospital level care a return of $9,647 against a care cost of $31,829. Returns of 30% - which even before tax, are extraordinary. And, when Thornton compared “not for profit” rest home operators against the “for profits”, EBITDAR were 68% higher in “for profit” operators. Though not listed on the share market, New Zealand’s second largest operator BUPA is definitely controlled offshore. Based in the UK with a core business as a health insurer in 190 countries BUPA operates/runs rest homes in UK, Spain, and Australia & New Zealand. BUPA purchased NZ-based but Australian-owned Guardian Healthcare Group (GHG) in 2007, rebranding in 2009. GHG had already changed hands twice previously in its short life with an estimated $150 million going offshore in the process. Today BUPA operates 46 rest homes and retirement villages “Indeed, the Overseas Investment Office said of BUPA, when considering its successful 2007 bid to acquire all the rest homes and hospitals and the personal alarm business of the NZ owned Guardian Healthcare Group: “The BUPA Group has a clear strategy of pursuing growth both in the United Kingdom and international markets particularly in the Australian and New Zealand markets where the BUPA group has identified opportunities for an experienced operator and provider of aged care businesses to make acquisitions and apply its international experience in the provision of aged care services. The acquisition will geographically diversify the BUPA Group's international operations and provide a platform to further expand its aged care and retirement village portfolio”. In its “Preliminary Results Announcement for the year ended 31 December 2010”, BUPA reported a 9% annual growth in total revenues (up to 7.58 billion), of which 4% came from expansion of its businesses, and 5% from favourable exchange rate transactions (more money for free for a transnational company). It also noted the differences in profitability of its UK and Australasian care services, and the reasons for this, saying of its BUPA Care Homes UK operation that: “Revenues grew and surplus was maintained despite public … funding restrictions, with the local authority fee increase across England from 1 April 2010 just 0.5%” (p. 10). Overall BUPA said that its Care Services division performed well, despite increasing pressure on public sector budgets in the UK, which was having an impact on aged care fees and referrals. In Australia and New Zealand however, the division benefited from “more benign economic conditions”. BUPA is engaged in political lobbying in the UK to try and prevent more cuts in public funding of its facilities. Its preliminary statement for 2010 also says that in response to the reduction in public spending on aged care it is “actively controlling costs”. It appears to be doing this already in New Zealand, despite the “more benign” economic environment. The Roger Award judges thought that BUPA deserved to be the second place getter primarily because of its poor treatment of both its staff and its clients. Admittedly, the NZ government has so far done nothing to promulgate and enforce regulations to require that rest homes are staffed by an appropriate number of properly qualified and paid staff, who give a reasonable amount of care (in quantity and quality) to their clients. The staffing guidelines that currently exist provide for extremely low ratios of qualified nursing staff to clients, and extremely small amounts of contact time between clients and caregivers – much lower than international best practice standards. In any case, these guidelines are purely voluntary. Staff are generally poorly paid, and frequently overworked, due to short‐staffing in their facility. The number and percentage of staff who are foreign nationals who are working in NZ rest homes, and for whom English is a second language, is not known, but we now know that three of these already vulnerable women (two Filipinas and one Thai) who were working for three different BUPA‐owned homes, were sadly killed in the February 22nd Christchurch earthquake while they were attending English language classes in the CTV Building, which collapsed on top of them http://www.bupa.co.nz/Care‐Homes‐News.aspx – accessed 15/3/11). Competent New Zealand registered nurses are often reluctant to work in aged care, largely because they know they will be expected to do impossible amounts of work, and still not be able to provide adequate care, which may leave them open to charges of professional negligence. In these staffing circumstances, is it any wonder that the quality of client care is extremely variable, and that there are now many well‐documented cases of elderly New Zealanders receiving poor care, or being so badly neglected or mistreated that they end up in a public hospital requiring acute care – where some of them die. One of these people was a resident in a BUPA rest home in Tauranga. For several months she suffered considerably from misdiagnosed and untreated scabies. This led to other complications which eventually killed her. BUPA management averred that it was meeting the industry standards of care for its client – which, as we have already seen are too low. It may well have been meeting those inadequate standards, but that is irrelevant if the actual care it delivered was insufficient to maintain the health and life of its client, caused her to suffer unduly, and ultimately caused her death. This would be bad enough if New Zealand were as poor as Haiti or Zaire, and unable to fund high standards of care for the elderly. But it is not, and therefore it is a public scandal that taxpayer's money, paid out as subsidies for care, is being used to increase the profits of foreign‐owned companies rather than provide proper care for New Zealanders. BUPA should be ashamed of itself, but it is only doing what all profit‐seeking companies will do if governments let them, which is to put profits before people. It is long past time that the aged care sector in New Zealand had a thorough overhaul, along the lines recommended by the report into aged care in New Zealand produced in 2010 by the Green and Labour Parties, in association with Grey Power. If at the end of that process companies like BUPA no longer find that the economic conditions in New Zealand are ''more benign'', so much the better for the health and wellbeing of elderly Kiwis. ” My suggestion is that staff make a counter proposal to the company. It is well known that businesses who are generous to their staff will prosper. If BUPA can be persuaded to INCREASE staffing as well as wages, (to bring them up to the level of DHB workers), they will foster a happy and caring environment amongst the staff which will flow on to the aged-care residents. This will lead to a greater occupancy rate as word gets around that BUPA are truly a good place to stay. It may mean a short term blip on the company’s ability to acquire more properties - but in the longer term they will reap their rewards. Rather than see Liston Heights as an example of cost overrun - lets make it the shining light of what can be done with a few dollars spent on extra staff to help achieve fantastic outcomes for the residents. |

Gregg SheehanMy first memory of being bullied was as a 5 year old going to the corner shop with sixpence that my mother gave me to get us a Crunchie Bar. A 'big' girl was outside the shop and threatened to run me over with her doll's pram if I didn't give her my money. I handed over the sixpence and went home crying.... ArchivesCategories |

Gregg's Diet Shack

- Journey

- Index

-

Basics

- Discussions by Subject >

- Foods - Nobody does it better than Georgia Ede >

-

The People

>

- Rosedale Lecture

- All Sorts of Links and Videos

- The 20 Myths

- Diet and Nutrition for the Australian People

- Diet, Nutrition and Biochemistry Blogs and Websites

- Discussion on the 'life expectancy' myth

- Micronutrients Veg vs. Meat

- Human History >

- The Fat of the Land

-

Diseases

-

The Studies

- Tools

- Blog

- Quotes

- Recipes

- Articles

- Contact

- RDA

- Liver Flush

- Smacking

- Controversy

- Whisky

- Lentils

- Chad

- IQ

- False

- Falseinfo

- factcheckgood

- factcheckivermectin

- TGC-Licence

- Moccasins

- totalgym

- Law

- Scooters

- Nami

- Search

RSS Feed

RSS Feed